Jan 25, 2009

Green jobs: There is Much To Be Learned

Labels: energy collective, environmental economics, John Whitehead

Jan 14, 2009

Russian Roulette: Energy geopolitics in the Russia-Ukraine gas row II

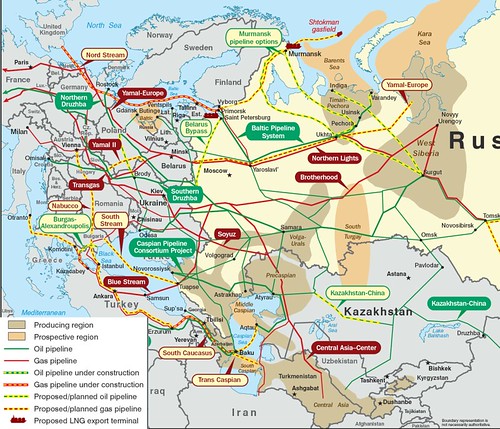

Map showing Russian natural gas pipelines. Credit: Energy Information Administration. Higher resolution version available here.

The article discusses the current dispute viewed through the foggy lens of Russo-Ukranian relations.

"...before 2004, the Russian-Ukrainian natural gas spat was simply part of business as usual. But now, Russia feels that its life is on the line, and that it has the financial room to maneuver to push hard — and so, the annual ritual of natural gas renegotiations has become a key Russian tool in bringing Kiev to heel."

Currently, 80% of European natural gas imports from Russia transit through Ukraine.

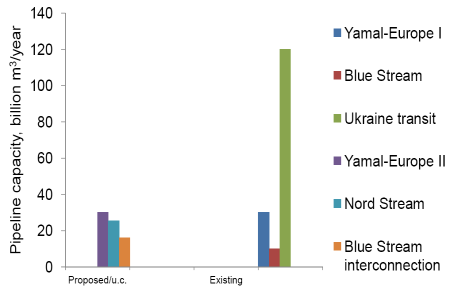

Russian exports to Europe via different pipelines, data from EIA. Abbreviations: u.c.: under construction

Apart from these Russian exports of natural gas, Europe also plans to import natural gas (liquefied or pipeline) through fields in Norway, Libya, Caribbean and Azerbaijan, totaling 117.5 billion m3/year by 2010. This will decrease European dependence on Russian natural gas imports. Among other things, the article differentiates German and other European approaches to Russia. This is because most of the German natural gas imports from Russia (43% of its natural gas consumption) transits through the Yamal-Europe I pipeline via Belarus and not Ukraine.Physics meets politics: Dr. Chu's confirmation hearings

Energy Star logo

During the hearing, he clarified his positions on coal (starting 51 min. in the video).

"...It is imperative that we figure out a way to use coal as cleanly as possible.."He is also is a proponent of efficiency. He thinks that President-elect Obama's energy plan is aggressive but achievable. Plugin hybrids, CCS, nuclear waste disposal, domestic oil and gas production, biofuels, smarter transmission & distribution system, a cap-and-trade system were some of the various ways mentioned (20:00 min). On the issue of nuclear fuel recycling, Dr. Chu thinks that it could be a part of a long-term solution (~35 min). In related news, the CEO of ExxonMobil said that he now supports a carbon tax instead of a cap-and-trade framework for controlling GHG emissions. On the other hand, other companies such as ConocoPhillips, BP are part of the United States-Climate Action Partnership (US-CAP)which advocates a cap-and-trade approach to mitigating GHG emissions.

Labels: clean coal technologies, DOE, nuclear energy, Secretary of Energy, Senate confirmation hearing, Steven Chu, transmission

Jan 12, 2009

Oil prices revisited..

The 60 Minutes show on CBS looked at the role of speculation in influencing recent spike and downturn in oil prices. Of note here is that there still seems to be little evidence that the markets were manipulated.

Nari has a couple of articles on this issue.

Opinion: Oil Prices Depend on More on Speculation than assumed previously

Speculation in Crude Oil, Middle men and prices

Jan 5, 2009

Energy geopolitics: the Ukraine-Russia gas dispute

Map of European natural gas pipelines. Credits: BBC, Petroleum Economist.

Essentially, Gazprom, the Russian gas monopoly wants to charge Ukraine 450 $/1000 m3 (MCM) of gas, a 150% increase from the existing rate of 179 $/1000 MCM. Because 40% of the gas to EU nations passes through Ukraine, a shut-off of Russian gas to Ukraine affects the downstream consumers. The figure is a map of proposed and existing natural gas pipelines and liquefied natural gas (LNG) storage terminals in-and-around Europe. Although Russia claims that part of the gas passing through Ukraine could be diverted via Belarus, consumers in Hungary, Poland Romania and Bulgaria have reported drops in natural gas supply. Here is a somewhat dated presentation describing the natural gas supply and demand outlook for EU-30 nations. According to this, net EU natural gas imports will grow to 670 billion cubic meters (BCM) of natural gas by 2030, accounting for 70% of the natural gas suppply. Of this, Russia is projected to supply 220 BCM (one-third of natural gas imports) by 2030. From this presentation, it is apparent that Russia has one of the the lowest costs for supplying natural gas on a $/MMBTU basis. The BBC has an interesting article on regional geopolitics that might play a role in resolving this issue.

What other options do European countries have in the long-term?

Poland has 24400 million short tons (Mmst) of coal, and is a big regional coal producer. Coal-to-gas technologies could play a significant

Conclusion: In the short-term, alternatives for relatively clean Russian natural gas might be difficult to find. European coal has a role to play in displacing some portion of Russian natural gas imports, but the long-term EU energy policy needs to address this issue in the context of geopolitics, GHG emissions, carbon trading frameworks and energy security.

See also: Russian Roulette: Energy geopolitics in the Russia-Ukraine gas row II

Labels: clean coal technologies, clean energy technologies, energy, geopolitics, natural gas, Russia, Ukraine

Jan 1, 2009

Glimpses through the Energy Crystal Ball : 2009

- Oil prices & clean tech-investments: The downward trend in the crude oil prices will likely continue atleast until Summer'09. A lot depends on the market perceptions of US and world economies. The current conflict in the Middle East has put a slight upward pressure on the oil prices, but this will likely be temporary. Short-term clean tech-investments will depend to a major extent on the availability of credit and the risk perceptions associated with various technologies. Investments in oil sands production have come to a standstill because of the lower demand and poor credit access.

- Carbon trading and renewable energy credits: Because it might be easier to get Congressional approval on a renewable portfolio standard (RPS), expect RPS standards at the state/Federal levels to be implemented before a cap-and-trade regime. However, various regional GHG programs will begin to play a greater role in influencing the debate on a Federal cap-and-trade regime. I think that rewarding early action to reduce GHG emissions/increased renewable-based power generation should be a key component of the RPS/carbon trading approach.

- Clean coal technologies: The high capital costs associated with clean coal technologies (IGCC, CTL, etc.) coupled with the low cost of crude oil (and natural gas) have limited investments in clean coal technologies. One notable example is the cancellation of SES-Consol Energy synthetic gasoline project in West Virginia. However, CTL projects elsewhere in the world seem to be going forward. Because these multi-billion dollar facilities take many years to build, it is essential to take a long-term view for these projects. On the other hand, financing will still be partly influenced by short-term market trends, and well-established companies with proven technologies will stand a better chance at getting financed.

Recently, Laurus Energy, the sole North American licensee for Ergo Exergy's εUCGTM underground coal gasification technology received financing from a Silicon Valley-based VC firm. This indicates that projects which aim to lower capital costs of conventional coal technologies could also likely succeed in getting financed. - Carbon capture and storage (CCS): Various players in the oil and gas industry and the power industry are following developments in the CCS field, and strategically positioning themselves. Exelon, for example, has a mid-term low carbon roadmap which incorporates elements of efficiency, along with low-carbon electricity production options such as natural gas, nuclear and renewables. Papers describing current industrial efforts in CCS from the recent Greenhouse Gas Technologies-9 conference can be found here. A comparative assessment of the World Resources Institute (WRI)'s CCS guidelines and emerging U.S./European geologic CO2 sequestration regulations is here (subscription might be required).

- Biofuels: My take on the short/medium-term implications of President-elect Obama's biofuel policy appeared as a guest post on The Big Biofuels Blog.

Conclusion: It would have been highly unlikely for someone to predict 40$/barrel crude prices at the beginning of previous year. The current economic slowdown will play a greater role in influencing both the consumption of energy and investments energy technologies. On the other hand, President-elect Obama plans to jumpstart the economy with a 850 billion $ infrastructure spending plan. The stakeholders must ensure that the current economic scenario is not another opportunity lost in addressing the problems of human development and sustainability.

Labels: 2009, carbon capture and storage, CCS, CO2 trading, CTL, energy outlook, Ergo Exergy, Exelon, UCG