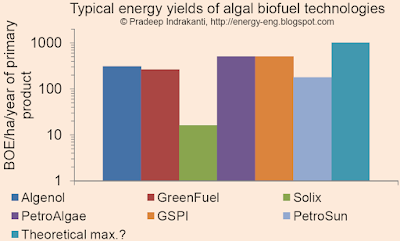

This is an examination of yields of "primary product" (algal oil/ethanol/biodiesel), expressed as barrels of oil equivalent/hectare of land area/year, from various algal (algae) biofuel technologies. I used data from company websites and press releases and converted the algal oil/ethanol production to a BOE/ha/year basis.

From the above figure, typical "yields" range from 100-1000 BOE/ha/yr. Compare this to Dr. Benemann's recent statement that the maximum algal yield without using genetically modified algae would be ~2000 gal algal oil/acre/year (101 BOE/ha/year).

Disclaimer: This is not meant to be a comparison of various processes or an endorsement/critique of a specific process. Utilization of and the value for the algal biomass and the biofuel determines the overall process economics. My assumptions and data are given below:

- Algenol: 6000 gal EtOH/acre/year

- Solix data from here.

- GreenFuel, from a previous post

- PetroAlgae: Assumed 200x current soybean oil yields (200x50 gal oil/acre/year).

- GSPI: Link here

- Theoretical maximum: from CircleBio's website, assuming 20,000 gal biodiesel worthy plant oil/acre/year.

- I further assumed that 1 T of algae oil gives 1 T of biodiesel, unless mentioned otherwise on the company's website (the ratio is ~0.96 for soy oil).

- Calorific value of 33MJ/L for biodiesel and 20 MJ/L for ethanol.

Related posts:

Analysis: Algae for CO2 capture - II

Analysis: Algae for carbon dioxide (CO2) capture