Map showing Russian natural gas pipelines. Credit: Energy Information Administration. Higher resolution version available here.

Stratfor has

an article on the wider geopolitical consequences of the Russia-Ukraine natural gas dispute. In an

earlier article, I briefly looked at other options to displace a portion of European natural gas imports from Russia. In this article, I will examine some of these options in greater detail.

The article discusses the current dispute viewed through the foggy lens of Russo-Ukranian relations.

"...before 2004, the Russian-Ukrainian natural gas spat was simply part of business as usual. But now, Russia feels that its life is on the line, and that it has the financial room to maneuver to push hard — and so, the annual ritual of natural gas renegotiations has become a key Russian tool in bringing Kiev to heel."

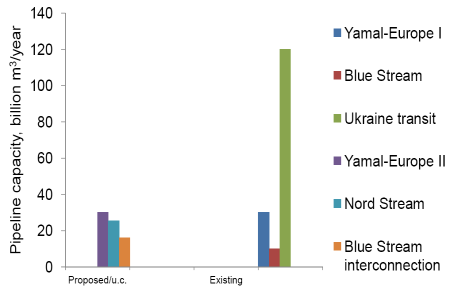

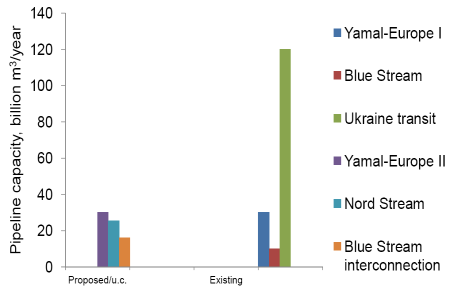

Currently, 80% of European natural gas imports from Russia transit through Ukraine.

Russian exports to Europe via different pipelines, data from EIA. Abbreviations: u.c.: under construction

Apart from these Russian exports of natural gas, Europe also plans to import natural gas (liquefied or pipeline) through fields in Norway, Libya, Caribbean and Azerbaijan, totaling 117.5 billion m3/year by 2010. This will decrease European dependence on Russian natural gas imports. Among other things, the article differentiates German and other European approaches to Russia. This is because most of the German natural gas imports from Russia (43% of its natural gas consumption) transits through the Yamal-Europe I pipeline via Belarus and not Ukraine.

Read More...

Summary only...