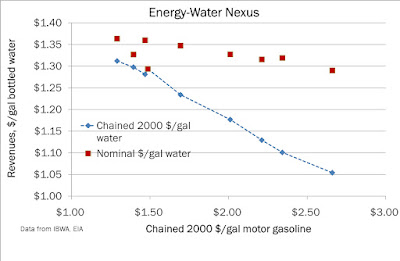

Effect of increased oil prices on bottled water revenues

Apr 1, 2010

Bottled Water - Energy

Apr 16, 2009

Book Review: "Energy & International War: From Babylon to Baghdad & Beyond"

The author notes that the European Union evolved from the European Coal and Steel Community, which was established to prevent future wars between France and Germany. One theme expressed in this book is that energy rarely is the main driver for international conflict, however, access to energy resources does play a role in shaping them, or as in WW I and II, influences their eventual outcomes.

Jan 5, 2009

Energy geopolitics: the Ukraine-Russia gas dispute

Map of European natural gas pipelines. Credits: BBC, Petroleum Economist.

Essentially, Gazprom, the Russian gas monopoly wants to charge Ukraine 450 $/1000 m3 (MCM) of gas, a 150% increase from the existing rate of 179 $/1000 MCM. Because 40% of the gas to EU nations passes through Ukraine, a shut-off of Russian gas to Ukraine affects the downstream consumers. The figure is a map of proposed and existing natural gas pipelines and liquefied natural gas (LNG) storage terminals in-and-around Europe. Although Russia claims that part of the gas passing through Ukraine could be diverted via Belarus, consumers in Hungary, Poland Romania and Bulgaria have reported drops in natural gas supply. Here is a somewhat dated presentation describing the natural gas supply and demand outlook for EU-30 nations. According to this, net EU natural gas imports will grow to 670 billion cubic meters (BCM) of natural gas by 2030, accounting for 70% of the natural gas suppply. Of this, Russia is projected to supply 220 BCM (one-third of natural gas imports) by 2030. From this presentation, it is apparent that Russia has one of the the lowest costs for supplying natural gas on a $/MMBTU basis. The BBC has an interesting article on regional geopolitics that might play a role in resolving this issue.

What other options do European countries have in the long-term?

Poland has 24400 million short tons (Mmst) of coal, and is a big regional coal producer. Coal-to-gas technologies could play a significant

Conclusion: In the short-term, alternatives for relatively clean Russian natural gas might be difficult to find. European coal has a role to play in displacing some portion of Russian natural gas imports, but the long-term EU energy policy needs to address this issue in the context of geopolitics, GHG emissions, carbon trading frameworks and energy security.

See also: Russian Roulette: Energy geopolitics in the Russia-Ukraine gas row II

Labels: clean coal technologies, clean energy technologies, energy, geopolitics, natural gas, Russia, Ukraine

Aug 8, 2008

Developing clean energy technologies: Role for green chemistry?

"Green chemistry consists of chemicals and chemical processes designed to reduce or eliminate negative environmental impacts. The use and production of these chemicals may involve reduced waste products, non-toxic components, and improved efficiency."

If we consider that the production of fuels is a chemical process, with the energy in the fuel being the output of the process, applying the twelve principles of green chemistry could potentially impact the way fuels are produced. Three of the twelve principles of green chemistry that can be applied to clean energy technologies are the use of renewable feedstocks, maximizing atom economy, and designing chemicals to degrade after use. Some of the important challenges for developing clean energy technologies from a green chemistry perspective are:

- How can we better use renewable materials to produce fuels or industrial feedstocks?

- How can we maximize atom efficiency the above conversions?

- How can we plan for chemical degradation/CO2 sequestration after use?

Additionally, planning for the end-of-life means that we should have effective means to recycle/reuse products derived from natural sources, and we that we should have strategies to mitigate CO2 emissions while using CTL. I do not advocate that we only use CTL technologies, but only that if we do, we should have some means to mitigate CO2 emissions in place.

Labels: clean energy technologies, corn, energy, green chemistry, PLA, poly lactic acid

Jun 30, 2008

Resource Conservation & Game Theory

Jeffrey Sachs seems to think that a cooperative approach on the world's most pressing problems of energy, water, raw materials will eventually help in sustaining high growth rates. I like his argument that the world economy has never been so large. This, he says necessitates greater conservation because free market economics which dictate that the prices be set by supply and demand will result in price spikes when disurption of supply/supply concerns set in. As an example, the above figure (credit: Yahoo Finance) shows how the NASDAQ and S&P 500 indices fell as the commodity prices rose in Feb'08. Back then (as it is now), concerns over global food production (mainly corn, rice) and the everincreasing oil prices led to the commodity price increases that we see today.

With my limited knowledge of economics, I think that Prof. Sachs's approach parallels John Nash's game theory. The most optimal distribution of resources (and the best global output) will occur when all the players (individual nations) coordinate their act and come together. However, in practice, every nation has its own strategic objectives which leads to lesser cooperation in sharing/developing the world's resources.

My views:

Conserving resources to save growth sounds like a noble idea. However, will India, China and the rest of the developing world wait until mutual understanding of resource use happen? The recently released Indian climate change plan emphasizes solar energy and sustainability. Given that most assessments of long term energy use have fossil fuels still being the major source of energy, it remains to be seen how far the present Indian government (and its successors) will go towards making climate action a reality.

Labels: climate change, commodity futures, energy, game theory, India, suppy and demand, sustainability, world markets