Aug 16, 2009

CO2 to fuels and chemicals

Jun 29, 2009

Electricity Load Reduction

Electricity load reduction test a success

The success was attributed to the many employees and students who cooperated by turning off unnecessary equipment and to OPP workers who made system-wide adjustments behind the scenes. The peak reduction for the hour was an impressive 15 percent (5000 kw) at 4 p.m.

Read the full story on Live: http://live.psu.edu/story/40286/nw63

Labels: electricity, load reduction, Penn State

Jun 22, 2009

Guest post: Is public transportation (or the lack of it) a CATAstrophe?

In this economic downturn, and automotive industries taking such a hard hit, many people are talking about alternative sources of energy, hybrid vehicles, solar panels etc. I understand it is necessary to invest more in this resource. I find it really hard to digest the fact that the automakers-GM, Chevy who once ruled the market and profits in America are now really on the debacle, filing for bankruptcy. Obama government is doing all possible things to save this industry.

However, the idea of this post was not to discuss possibilities and changes that could be brought out. I am trying to focus on the public transportation system in my city- State College, the home of the Pennsylvania State University, a highly acclaimed university.

Its better to invest in public transportation, mass transit facilities, rail lines etc, than to focus on bringing newer cars into the market. We do have a buses in State college that helps people travel from place to place. However, we need to realize that State college is merely an university town and most people staying here are students.

CATA, as they call it,stands for Center Area Transportation Authority. The best part of this system is that the buses run clean, burning compressed natural gas. Hence, I feel that in a small way, we are trying to be eco-conscious. However, I am against this system for the fact that its too expensive to ride the bus.

I tried working out a balance sheet for the month and this is what I found.

Buying a pass for the month on the CATA line : $ 49

If you own a car and drive to school daily, (You anyways pay for the car insurance even if you do not drive to school), then

cost of fuel for the entire month= $25

Parking cost at the univ = $8 /month

Total= $ 33

This results in a saving of $16 a month. Which on an annual basis reflects to about $185.

This just goes to show that CATA bus service is really expensive. For a transit system that is funded by the county or the state, these services must be cheap. Infact, in many universities, local bus rides are free if you flash your ID.

So what motivates me against taking the bus?

If I drive to school, I can leave home at the time I want. This means that my schedule does not depend on the bus timings. Also, I get to save 15 to 20 bucks a month, depending on how much i drive.

If you are a staff at PSU, you definitely earn more than students, and CATA charges them just 5 bucks a month on the monthly pass. How logical is this?

I'd rather burn more fuel on my car (which I feel sad to say since I am an automotive engineer), but then I am justified in doing so.

Is there a solution to this?

Jun 1, 2009

The role of energy in organic farming

The farmer who the reporter talked to reportedly switched to organic farming because he was getting marginally diminishing returns with each application of pesticides and fertilizers. This means that to maintain crop yields, one must use more pesticides and fertilizers every year. Now, I do not find anything wrong with using fertilizers and pesticides, as long as they are used wisely. However, farmer literacy about agrochemical use in India is sorely lacking. Moreover, the government subsidizes fertilizer prices for the farmers, thereby indirectly contributing to their overuse. Additionally, because the cost to the farmer varies directly with both unit cost of fertilizer (which has not been changed for many years, despite the wild swings in energy prices over the past 9 years) and the quantity consumed, even an increase in the amount of fertilizer/pesticide used per unit area can be a financial burden to the farmer. Therefore, in some cases, it makes sense to go organic altogether.

However, as the Punjab State Farmers' Association report noted, widespread adoption of organic farming will likely lead to short-term food shortages, because of reduced yields in the most productive farms. Therefore, I think that India should slowly shift away from farm subsidies, promote organic farming -but not to the extent that it would lead to short-term food shortages, and finally promote smarter use of resources, both agrochemicals as well as water. Examples include growing crops which fix nitrogen along with crops which require nitrogen, such as beans with wheat, and soybeans with corn.

"Environmental groups in India estimate that more than 300,000 farmers like Sharma have switched to organic growing methods in recent years, or have started the transition from conventional to organic farming. Comparisons between India and the U.S. are difficult because their economies and cultures are so different. But consider this: India has about three times the population of the U.S., but 30 times more organic farmers than the U.S."

The average farm size in India is a fraction of that in the U.S.

Nitrogen fertilizers are a double edged sword because firstly, the production of ammonia (from which most urea-based fertilizers are made) emits CO2 (by processes such as naphtha steam reforming). Moreover, after the nitrogen fertilizers are applied to the soil, the urea is oxidized to nitrates and nitrites. When fertilizers are over-applied, these nitrates are washed off into rivers, causing algal blooms and utrophication. On the other hand, the Haber process for the manufacture of ammonia is credited with increasing the crop productivity in many parts of the world. This is a question for future world leaders: How do we balance the need to feed our growing population with the need to promote smarter use of resources and prevent unintended consequences?

Labels: energy prices, fertilizer prices, India, NPR, organic farming, pesticides

May 18, 2009

Change at the Energy Engineering Blog

Apr 17, 2009

GHG update: EPA's endangerment finding & Pew Center's analysis of Waxman-Markey draft

My take of this will follow in a separate article. Meanwhile, read the Environmental Capital blog's reaction here.

Labels: ACESA, climate change, Endangerment Ruling, EPA, Waxman-Markey

Apr 16, 2009

Book Review: "Energy & International War: From Babylon to Baghdad & Beyond"

The author notes that the European Union evolved from the European Coal and Steel Community, which was established to prevent future wars between France and Germany. One theme expressed in this book is that energy rarely is the main driver for international conflict, however, access to energy resources does play a role in shaping them, or as in WW I and II, influences their eventual outcomes.

Apr 12, 2009

Curiouser and curiouser!: Underground Coal-to-Liquids (UCTL) pilot test

UCTL Process flow diagram (click for an enlarged picture), source

My comments

One cannot strictly compare the UCTL process to UCG (underground coal gasification) process. UCG technology aims to utilize stranded coal resources (not necessarily limited to lignites), and therefore requires some capital outlay for advanced (horizontal) drilling equipment. On the other hand, from the information available, it seems that the UCTL process works with mineable coal seams as well (seam depth > 50 m). Whereas previous UCG pilot tests have established to some level of certainty that groundwater pollution can be avoided, this is doubly important for the UCTL technologies where significantly higher quantities of water and other chemicals (catalysts) are likely injected. Other competitors to UCTL processes include the Syntroleum-Linc Energy air-based UCG-synfuel process also produces above-ground Fischer-Tropsch liquids from air-blown UCG syngas.

Two other issues might also be important: namely, the availability of supplementary "natural catalysts/impurities located in all coal seams" (coals are necessarily heterogeneous) and the real extent of zeolite-formation and CO2 sequestration.

Apr 10, 2009

UCG update: Lower CO2 emissions compared to NGCC

My previous UCG post:

Underground Coal Gasification: Keep the coal in the ground, convert it to gas

Apr 7, 2009

"That Which Belongs To None Belongs To Every One" : Arctic Climate Change & Energy Geopolitics

Verne wrote about energy resources (coal) in the Arctic & the possibility of human-engineered climate change resulting in enhanced access to these resources. Credits

The quote in the title comes from "The Purchase of the North Pole". In contrast to fiction, Borgerson contends that U.S. still has to verify the U.N. Law of Sea Convention, improve cooperation with Canada and retrofit its aging icebreaker fleet. According to the USGS, the Arctic likely has 13% of the world's undiscovered oil (90 billion barrels) and 30% of the world's undiscovered gas (1670 trillion cubic feet). Whereas more than 70% of the undiscovered oil resource is estimated to occur in Arctic Alaska, Amerasia Basin, East Greenland Rift Basin, East Barents Basin and West Greenland-East Canada basins, the distribution of natural gas is more concentrated. More than 70% of undiscovered natural gas resources is estimated to occur in West Siberian Basin (Russia), East Barents Basin and Arctic Alaska (USGS factsheet, pdf). The USGS estimated that it would take 37 $/barrel to produce oil from a big (billion barrel) field. Note that the associated natural gas produced is reinjected in these calculations. The WSJ points out that:

[L]arge parts of the Arctic, especially offshore, remain unexplored.

In his article, Borgerson notes:

At the same time, Arctic countries are closely collaborating on mapping the area's seafloor, with scientists from one country frequently sailing on icebreakers of another. On the face of it, everyone seems to be getting along swimmingly.

But all of this camaraderie is at odds with the growing remilitarization of the Arctic. The region is in the midst of transforming from a frozen, sleepy backwater into a potential epicenter of world affairs. How this all plays out in the geopolitical development of the region is a story that is very much still being written.

Arguments in support of various countries' claims to portions of the Arctic can be found here. A map showing various claims in shown below. An interactive version of the map can be found at Spiegel online.

Map of Russian Arctic claims © BBC

Russian developments constitute a major portion of Borgerson's article. He notes that Russia has the largest icebreaker fleet, and that Gazprom is aggressively developing the Shtokman natural gas field, and considering potential future LNG exports to the US eastern seaboard. Interestingly, Borgerson also notes that countries without Arctic coastlines such as China, South Korea, Japan are also participating in Arctic expeditions or are involved in building icebreakers and ice-strengthened tankers.

My opinions:

There are indications that the Arctic likely contains large oil and gas resources. However, the comparatively high cost of crude production in the Arctic indicate that production would not be economical in a market with low crude prices. Additionally, developing the natural gas resource located in the Russian Arctic is likely to involve significant investments in infrastructure, either as liquefied natural gas (LNG)-carrying tankers, or floating production and offloading platforms where the gas is converted on-board to liquid fuels such as methanol. The prospect of refreezing winter seas and rough weather would make operations on oil and gas production platforms a dangerous affair by today's standards. Therefore, I would expect the shipping/tanker companies to be the initial beneficiaries of an ice-free Arctic. Projects such as the Shtokman field would benefit from seasonal ice-free shipping lanes which reduce distances to markets, both in the US as well as South-East Asia/Far East.

Unlike the events in Verne's novel, where the representatives of Britain, Sweden-Norway, Holland, Denmark and Russia agree to form a syndicate against the American-represented North Polar Practical Association, alliances over the ice-free oceans would be tenuous. Recently, Denmark and Canada held talks on the delineation of the limits of the outer continental shelf. The Russian claim over the North Pole would be evaluated by the United Nations Commission on the Limits of the Continental Shelf (CLCS) this May. It is in U.S. interests to ratify the U.N. Convention on the Law of the Sea to have a role in these discussions. Regardless of these outcomes, one fact stands clear; no diplomat or leader can dare to think in similar lines to Jacques Jansen, the Netherlands' representative to the Arctic auction in Jules Verne's novel, who scoffs at the value of the Arctic ocean:

It would be much better to buy a load of codfish than to throw one’s money into the ice-water of the North.

Labels: arctic, climate change, energy geopolitics, Russia, sea ice

Carbon dioxide Sequestration Revisited

Artist visualization of CO2 sequestration of CO2 from a coal fired power plant into brine deep below the ground

Just read an article on Chemical and Engineering News (C&EN) that Dow Chemicals and Air Products have signed separate agreements to capture and sequester CO2 emitted from coal fired power plants in US and Germany, respectively.Dow's proposed agreement is with Alstom for a pilot plant to be built at South Charleston W.Va. They are proposing about 1800 tons/yr of CO2 capture from the flue gases of a coal fired boiler. The removal technology here is an amine based CO2 removal post capture method.

The Air Products project is Germany is with the Swedish utility company Vattenfall AB. Sequestration options are being explored currently. More details can be found in the source article [Link]. New findings in the the sequestration of CO2 indicate that substantial amount of underground CO2 may remain dissolved in deep formation brine, rather than getting fixed into mineral carbonates, as previously believed.

Sources

C&EN

Nature

Labels: Air Products, CO2 sequestration, Dow Chemical, power plant

Mar 31, 2009

Geo-Engineering & Irreversible Climate Change

Will Geo-Engineering Get Us Out of a Potential One-Way Street?

On a related topic, in a recent paper published in the Proceedings of the National Academy of Sciences (PNAS, USA), Solomon et al. indicate that if CO2 concentrations in the atmosphere (currently at 385 ppm) peak to 450-600 ppm (despite zero CO2 emissions) and atmospheric temperatures would not drop significantly for at least a century. Irreversible dry-season rainfall reductions are one of the impacts predicted by their modeling study.

My comments:

Although geo-engineering through albedo enhancers may decrease atmospheric temperatures, it does not directly reduce the amount of CO2 in the atmosphere. Additionally, a recent study found that the use of albedo enhancers will limit the amount of sunlight available to plants. Other techniques such as iron fertilization are highly controversial, and as the Lohafex trial concluded, are likely to be only marginally beneficial. On the other hand, even if the major CO2 emitters reduce their emissions, it is likely that CO2 levels in the atmosphere will be high enough to worry policymakers in various countries to consider the extreme step of modifying the climate to fix the climate. To prepare for this eventuality, increased scientific collaboration on geo-engineering should be encouraged, so that the risks of various approaches can be evaluated.

Other articles of interest:

Tim Lenton and Nem Vaughan. The radiative forcing potential of different climate geo-engineering options. Atmospheric Chemistry and Physics Discussions, January 28, 2009

Labels: albedo enhancers, climate change, geo-engineering, iron fertilization

Mar 23, 2009

Lohafex project update: Iron fertilization in Southern Ocean fixes little CO2

Some processes involved in iron fertilization of the ocean.

As shown in the figure, this is a delicate balance between nutrient availability, settling rates and other creatures which consume phytoplankton. The team found that the additional plankton was consumed by microscopic animals. Additionally, the team discovered that their experiment ran into silicic acid (H4SiO4) limitations, with the result that diatoms were not the dominant species observed in the bloom.

Mar 22, 2009

Earth Hour 2009

A friend of mine casually mentioned to me about Earth hour coming up and reminded me to switch off lights on Saturday. That set me thinking about trying to organize a small Earth day party, with no lights. People could wear a fluorescent T-shirt or paint messages on blank Tshirts with Fluorescent fabric paint and wear them to the Earth hour party (a party with no lights obviously!).The idea is to get people to something fun without using electricity for 1 hour.

To observe Earth hour completely, my recommendation would be turn off all non-essential electricity powered appliances. That would mean,

actually unplugging:

- Televisions

- Cell phone chargers and other vampire electricity suckers, if not in use. (you could do this everyday)

- Turning off computers or atleast placing them on standby.

- You could go for a walk or a run

- Singing with your friends

- Try to have a candle light dinner

- Try to meditate

- Be creative

Mar 10, 2009

Dr. Steven Chu's talk with Charlie Rose

Mar 4, 2009

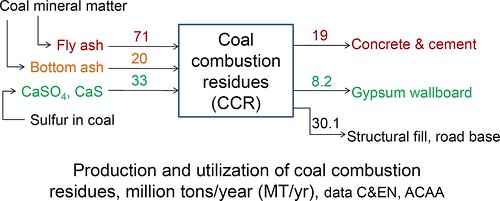

Coal combustion residues

The cement industry is the single largest consumer of fly ash. This works, because blending flyash into clinker not only is beneficial economically, but also enhances durability of the concrete. However, low-NOx regulations resulted lower firing temperatures, which result in unburnt carbon in fly ash. Cement manufacturers could co-fire high-carbon fly ash in their kilns as a component of the raw kiln feed, provided that certain precautions are taken. Additionally, research at Penn State & the University of Nottingham has focused on using the unburnt carbons in the fly ash to capture mercury emissions from power plants. Fly ash can also be used to make bricks, The Greenest Brick Company being an example.

Environmental implications of coal combustion residue handling and disposal are critical, because of the potential for heavy metal contamination and other health issues. Therefore, enhanced utilization of coal combustion residues should be one component of environmentally responsible utilization of coal.

Labels: bottom ash, cardboard, cement, clean coal technologies, fly ash, gypsum

Mar 2, 2009

Oil geopolitics in Central Asia & the Caucasus

South Caucasus Central Asia

View Larger Map

View Larger Map

Baku-Tbilisi-Ceyhan and other pipelines. Credit: Wikipedia

Historically, this region had Russian, Persian, Turkish, and Chinese political, cultural and social influences. As one of the commentators alluded to, this is a fight for the control of the center of the oil & gas-rich Eurasian landmass. As they say in chess, it is all about controlling the center.

Labels: Baku-Tbilisi-Ceyhan pipeline, Central Asia, crude oil, geopolitics, Russia, USSR

Mar 1, 2009

Sinking ship? Shell exec thinks not....

Labels: crude oil, national security, offshore drilling, Shell

Feb 28, 2009

Paper vs. Plastic?: BYOB

Bring Your Own Bag for Shopping. Original bag picture from buffaloreuse.wnymedia.net

From a public policy perspective, the recent NY plan to tax plastic bags is a one-sided approach to the problem. This is because plastic bags consume less water to produce compared to paper bags. Additionally, some studies indicate that paper bags do not decompose in landfills. Here is a link to a life cycle analysis comparing paper vs. plastic bags. Therefore, any policy that taxes plastic bag use (indirectly) provides incentives for retailers to use paper bags, which when not recycled are not significantly better for the environment.

Most arguments for the use of plastic bags indicate that recycling is environmentally responsible. After discussing this with my friends, I also think that reusing old bags is also a good way to eliminate waste. For example: Today, at the grocery, I asked the cashier not to bag my items because I already had plastic bags in my car. I simply transferred the items to the plastic bags and will continue to have a handful of plastic bags in my car to cover for any contingencies.

Therefore, I think that the argument should not be about paper vs. plastic. Rather, the discussion should be about how we could better reuse and recycle both bags. Let us know in the comments how you plan to reduce your plastic & paper waste.

Labels: Bring Your Own Bag, paper bags, plastic bags, recycling, reuse

Feb 23, 2009

Surface Radiation Calculations

I don't have clear arguments or time right now for the all graphs of CO2/warming shown subjectively. It could go either way.

But first, imo, the author does not even know how to define a system for performing energy balances. Because of this he does not know how to add the necessary terms to achieve a 1st law energy balance. Clearly, if you look at the total energy balance, the incoming and outgoing solar radiation fluxes at the outer boundary of the atmosphere add up fine (342 coming in and 107+235 going out at the atmosphere level, from space).

This author is forgetting the fact that the earth is round and receives radiation at different times throughout the day and radiates it back. Consequently it is possible to radiate 390 (+ 78+24 also shown in the image) because earth is also getting back radiation of 324 apart from the 168.

Further if you do a surface balance that also adds up fine. See image of my excel calculation below.

The original paper from which they obtain the Fig 8 is here (pdf) where towards the end the authors clearly put forward the errors etc in the model and still clearly show that an energy balance has been achieved. Further the Ashworth "paper" is written like an opinion piece and (gasp) and shows lack of simple mathematical concepts.

The original paper from which they obtain the Fig 8 is here (pdf) where towards the end the authors clearly put forward the errors etc in the model and still clearly show that an energy balance has been achieved. Further the Ashworth "paper" is written like an opinion piece and (gasp) and shows lack of simple mathematical concepts.But the bigger issue with anthropogenic CO2 related global warming is not the average daily solar fluxes, it is the release of the chemical energy trapped for millions of years in carbon bonds. The resulting CO2 release into the atmosphere is what is being considered as a precursor to global climate changes.

I should add at this point, my personal view on the subject of global warming and climate change is still not firmed up. I am merely an advocate for efficient use of resources, irrespective of whether they are carbon based or not. But what really bothers me sometimes is people pointing fingers at others, but making similar mistakes themselves.

Feb 17, 2009

Game-changing clean energy technologies?

For one, I can think of a cross between the Reva and the Nano. Tom Friedman talks of a hybrid solar-electric car in India which derives 10% of its energy consumption using PV panels. Something like this, would not only alleviate pressure on oil imports (for both India and China), but also be cheap enough to make a realistic difference.

Feb 4, 2009

MIT Clean Energy Competition

The MIT Clean Energy Prize is a student business plan competition open to all full time students in the US. Over $500,000 in cash and other prizes will be awarded to the grand prize winning team, and to category winners.More information about the categories can be found under sponsor information and other locations on the CEP website.

Grand prize: $200,000 cash prize (sponsored by NSTAR and the US Department of Energy) plus legal advice and support to help launch successful businesses.

Categories: Biomass, Clean Hydrocarbons, Energy Efficiency, Renewables, and Transportation.

Past year's winners included FloDesign wind turbine, Covalent solar and Catalyzed combustion technologies.

Labels: business plan, clean energy technologies, co2 mitigation, entrepreunership

Feb 2, 2009

Energy ads: Superbowl XLIII

Here are a couple of GE ads from the Superbowl

Wind energy:

Smartgrid technologies:

GE is working with a handful of utility companies (Duke Energy etc.) to promote smartgrid technologies. I also came across the supposedly eco-friendly Steelers superbowl t-shirt, made from organic cotton. Apart from this, I do not see how selling this t-shirt would be eco-friendly..

Labels: ecomagination, GE, smart grid, Superbowl XLIII, Wind power

Jan 25, 2009

Green jobs: There is Much To Be Learned

Labels: energy collective, environmental economics, John Whitehead

Jan 14, 2009

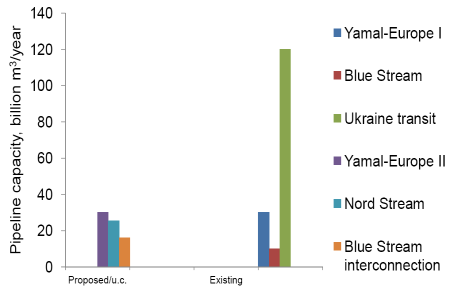

Russian Roulette: Energy geopolitics in the Russia-Ukraine gas row II

Map showing Russian natural gas pipelines. Credit: Energy Information Administration. Higher resolution version available here.

The article discusses the current dispute viewed through the foggy lens of Russo-Ukranian relations.

"...before 2004, the Russian-Ukrainian natural gas spat was simply part of business as usual. But now, Russia feels that its life is on the line, and that it has the financial room to maneuver to push hard — and so, the annual ritual of natural gas renegotiations has become a key Russian tool in bringing Kiev to heel."

Currently, 80% of European natural gas imports from Russia transit through Ukraine.

Russian exports to Europe via different pipelines, data from EIA. Abbreviations: u.c.: under construction

Apart from these Russian exports of natural gas, Europe also plans to import natural gas (liquefied or pipeline) through fields in Norway, Libya, Caribbean and Azerbaijan, totaling 117.5 billion m3/year by 2010. This will decrease European dependence on Russian natural gas imports. Among other things, the article differentiates German and other European approaches to Russia. This is because most of the German natural gas imports from Russia (43% of its natural gas consumption) transits through the Yamal-Europe I pipeline via Belarus and not Ukraine.Physics meets politics: Dr. Chu's confirmation hearings

Energy Star logo

During the hearing, he clarified his positions on coal (starting 51 min. in the video).

"...It is imperative that we figure out a way to use coal as cleanly as possible.."He is also is a proponent of efficiency. He thinks that President-elect Obama's energy plan is aggressive but achievable. Plugin hybrids, CCS, nuclear waste disposal, domestic oil and gas production, biofuels, smarter transmission & distribution system, a cap-and-trade system were some of the various ways mentioned (20:00 min). On the issue of nuclear fuel recycling, Dr. Chu thinks that it could be a part of a long-term solution (~35 min). In related news, the CEO of ExxonMobil said that he now supports a carbon tax instead of a cap-and-trade framework for controlling GHG emissions. On the other hand, other companies such as ConocoPhillips, BP are part of the United States-Climate Action Partnership (US-CAP)which advocates a cap-and-trade approach to mitigating GHG emissions.

Labels: clean coal technologies, DOE, nuclear energy, Secretary of Energy, Senate confirmation hearing, Steven Chu, transmission

Jan 12, 2009

Oil prices revisited..

The 60 Minutes show on CBS looked at the role of speculation in influencing recent spike and downturn in oil prices. Of note here is that there still seems to be little evidence that the markets were manipulated.

Nari has a couple of articles on this issue.

Opinion: Oil Prices Depend on More on Speculation than assumed previously

Speculation in Crude Oil, Middle men and prices

Jan 5, 2009

Energy geopolitics: the Ukraine-Russia gas dispute

Map of European natural gas pipelines. Credits: BBC, Petroleum Economist.

Essentially, Gazprom, the Russian gas monopoly wants to charge Ukraine 450 $/1000 m3 (MCM) of gas, a 150% increase from the existing rate of 179 $/1000 MCM. Because 40% of the gas to EU nations passes through Ukraine, a shut-off of Russian gas to Ukraine affects the downstream consumers. The figure is a map of proposed and existing natural gas pipelines and liquefied natural gas (LNG) storage terminals in-and-around Europe. Although Russia claims that part of the gas passing through Ukraine could be diverted via Belarus, consumers in Hungary, Poland Romania and Bulgaria have reported drops in natural gas supply. Here is a somewhat dated presentation describing the natural gas supply and demand outlook for EU-30 nations. According to this, net EU natural gas imports will grow to 670 billion cubic meters (BCM) of natural gas by 2030, accounting for 70% of the natural gas suppply. Of this, Russia is projected to supply 220 BCM (one-third of natural gas imports) by 2030. From this presentation, it is apparent that Russia has one of the the lowest costs for supplying natural gas on a $/MMBTU basis. The BBC has an interesting article on regional geopolitics that might play a role in resolving this issue.

What other options do European countries have in the long-term?

Poland has 24400 million short tons (Mmst) of coal, and is a big regional coal producer. Coal-to-gas technologies could play a significant

Conclusion: In the short-term, alternatives for relatively clean Russian natural gas might be difficult to find. European coal has a role to play in displacing some portion of Russian natural gas imports, but the long-term EU energy policy needs to address this issue in the context of geopolitics, GHG emissions, carbon trading frameworks and energy security.

See also: Russian Roulette: Energy geopolitics in the Russia-Ukraine gas row II

Labels: clean coal technologies, clean energy technologies, energy, geopolitics, natural gas, Russia, Ukraine

Jan 1, 2009

Glimpses through the Energy Crystal Ball : 2009

- Oil prices & clean tech-investments: The downward trend in the crude oil prices will likely continue atleast until Summer'09. A lot depends on the market perceptions of US and world economies. The current conflict in the Middle East has put a slight upward pressure on the oil prices, but this will likely be temporary. Short-term clean tech-investments will depend to a major extent on the availability of credit and the risk perceptions associated with various technologies. Investments in oil sands production have come to a standstill because of the lower demand and poor credit access.

- Carbon trading and renewable energy credits: Because it might be easier to get Congressional approval on a renewable portfolio standard (RPS), expect RPS standards at the state/Federal levels to be implemented before a cap-and-trade regime. However, various regional GHG programs will begin to play a greater role in influencing the debate on a Federal cap-and-trade regime. I think that rewarding early action to reduce GHG emissions/increased renewable-based power generation should be a key component of the RPS/carbon trading approach.

- Clean coal technologies: The high capital costs associated with clean coal technologies (IGCC, CTL, etc.) coupled with the low cost of crude oil (and natural gas) have limited investments in clean coal technologies. One notable example is the cancellation of SES-Consol Energy synthetic gasoline project in West Virginia. However, CTL projects elsewhere in the world seem to be going forward. Because these multi-billion dollar facilities take many years to build, it is essential to take a long-term view for these projects. On the other hand, financing will still be partly influenced by short-term market trends, and well-established companies with proven technologies will stand a better chance at getting financed.

Recently, Laurus Energy, the sole North American licensee for Ergo Exergy's εUCGTM underground coal gasification technology received financing from a Silicon Valley-based VC firm. This indicates that projects which aim to lower capital costs of conventional coal technologies could also likely succeed in getting financed. - Carbon capture and storage (CCS): Various players in the oil and gas industry and the power industry are following developments in the CCS field, and strategically positioning themselves. Exelon, for example, has a mid-term low carbon roadmap which incorporates elements of efficiency, along with low-carbon electricity production options such as natural gas, nuclear and renewables. Papers describing current industrial efforts in CCS from the recent Greenhouse Gas Technologies-9 conference can be found here. A comparative assessment of the World Resources Institute (WRI)'s CCS guidelines and emerging U.S./European geologic CO2 sequestration regulations is here (subscription might be required).

- Biofuels: My take on the short/medium-term implications of President-elect Obama's biofuel policy appeared as a guest post on The Big Biofuels Blog.

Conclusion: It would have been highly unlikely for someone to predict 40$/barrel crude prices at the beginning of previous year. The current economic slowdown will play a greater role in influencing both the consumption of energy and investments energy technologies. On the other hand, President-elect Obama plans to jumpstart the economy with a 850 billion $ infrastructure spending plan. The stakeholders must ensure that the current economic scenario is not another opportunity lost in addressing the problems of human development and sustainability.

Labels: 2009, carbon capture and storage, CCS, CO2 trading, CTL, energy outlook, Ergo Exergy, Exelon, UCG